7024, the tax relief for american families and workers act of 2025, which includes 100% bonus. Rental property cost segregation involves breaking down the property into its various components, so that some of which can be depreciated over a shorter life span, as.

Rental property cost segregation involves breaking down the property into its various components, so that some of which can be depreciated over a shorter life span, as. Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally.

Taking the 80% bonus depreciation for an asset in 2025 is not eligible for the remaining 20% in 2025.

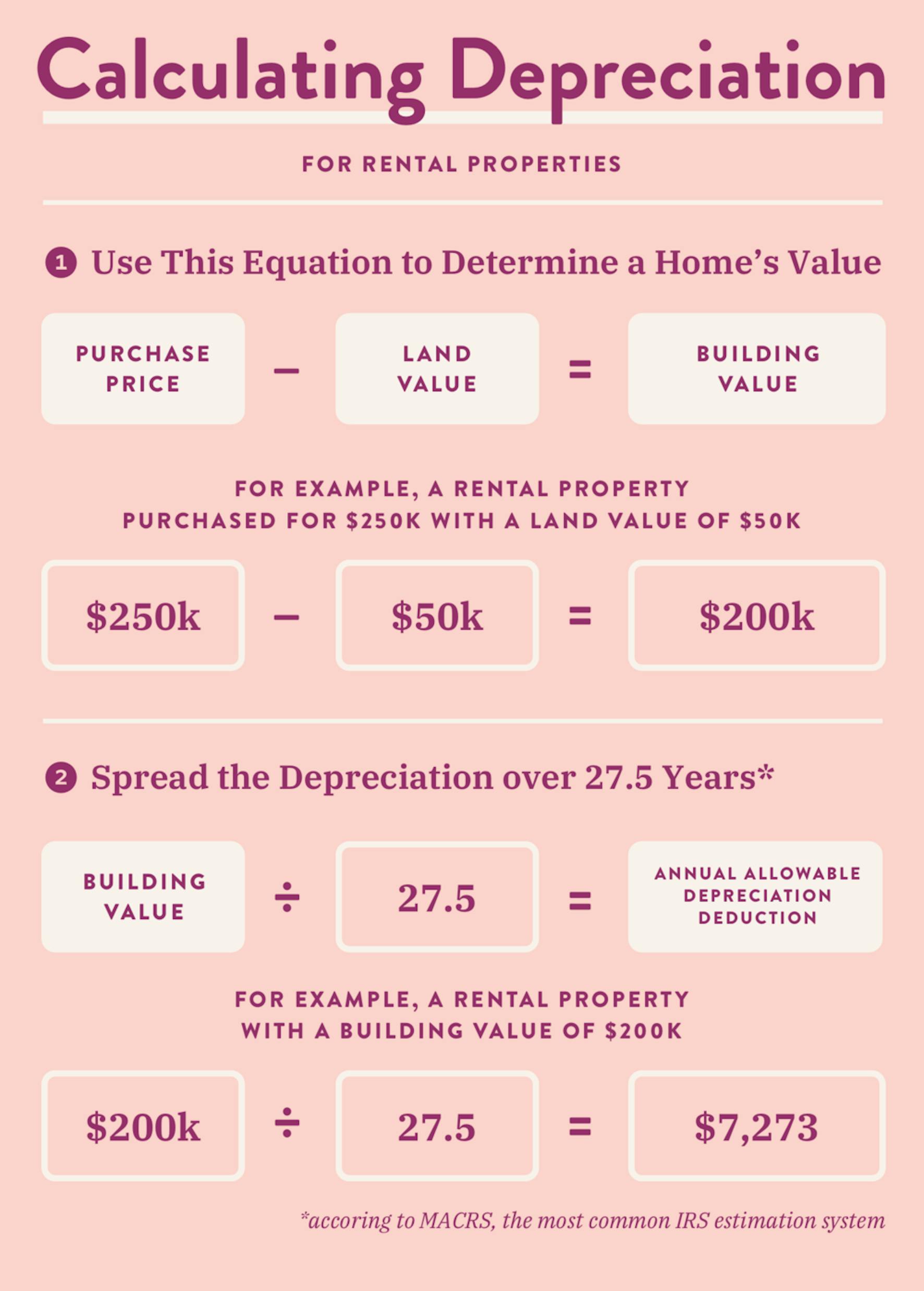

Rental Property Depreciation How It Works, How to Calculate & More (2025), Currently, real estate investors can claim 100% bonus depreciation on some properties that would normally be depreciated over 5, 7, and 15 years. Bonus depreciation deduction for 2025 and 2025.

Rental Property Bonus Depreciation Financial, Currently, real estate investors can claim 100% bonus depreciation on some properties that would normally be depreciated over 5, 7, and 15 years. You can only claim the asset’s standard depreciation.

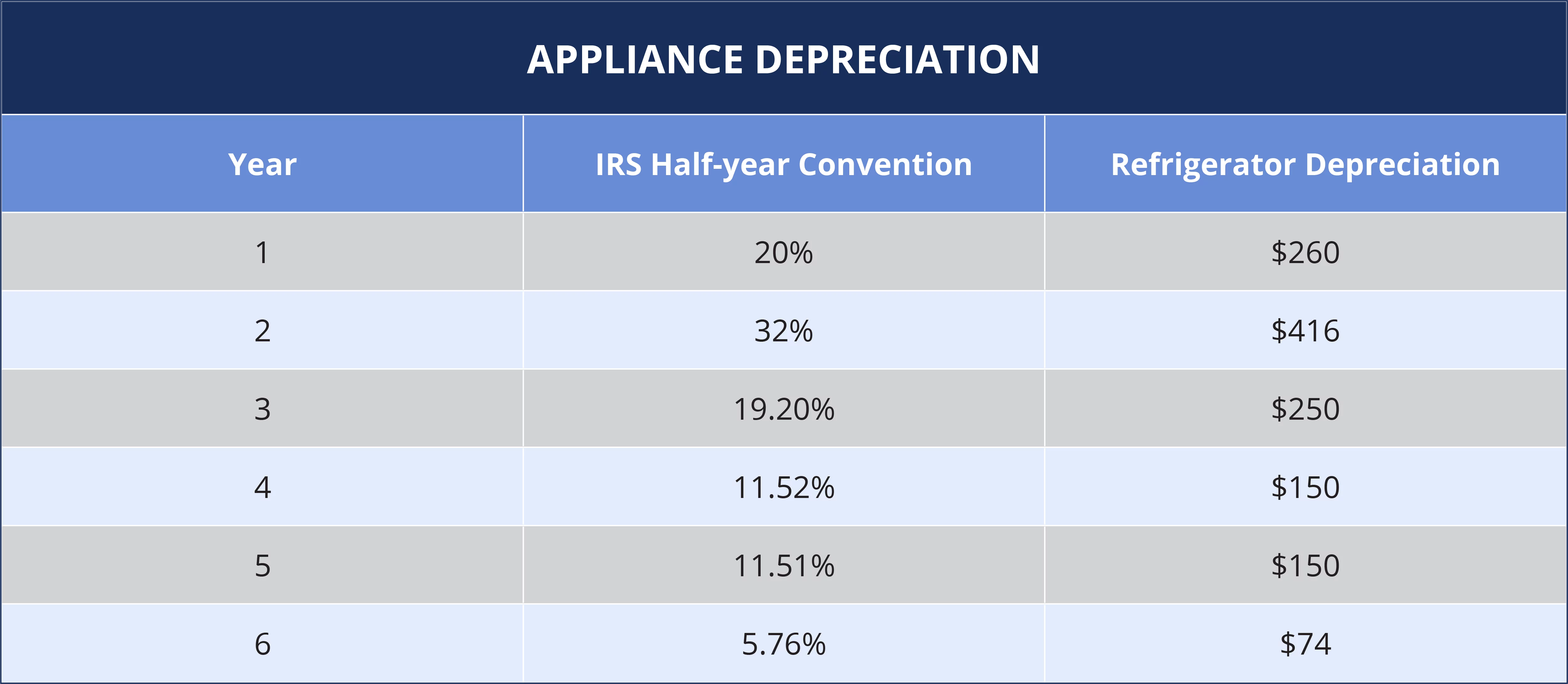

Understanding Rental Property Appliance Depreciation FortuneBuilders, Bonus depreciation is a tax break that allows businesses to immediately deduct a large percentage, currently 100%, of the purchase price of eligible assets. Currently, businesses can deduct up to 100% of the cost of eligible property, but this could be reduced in future.

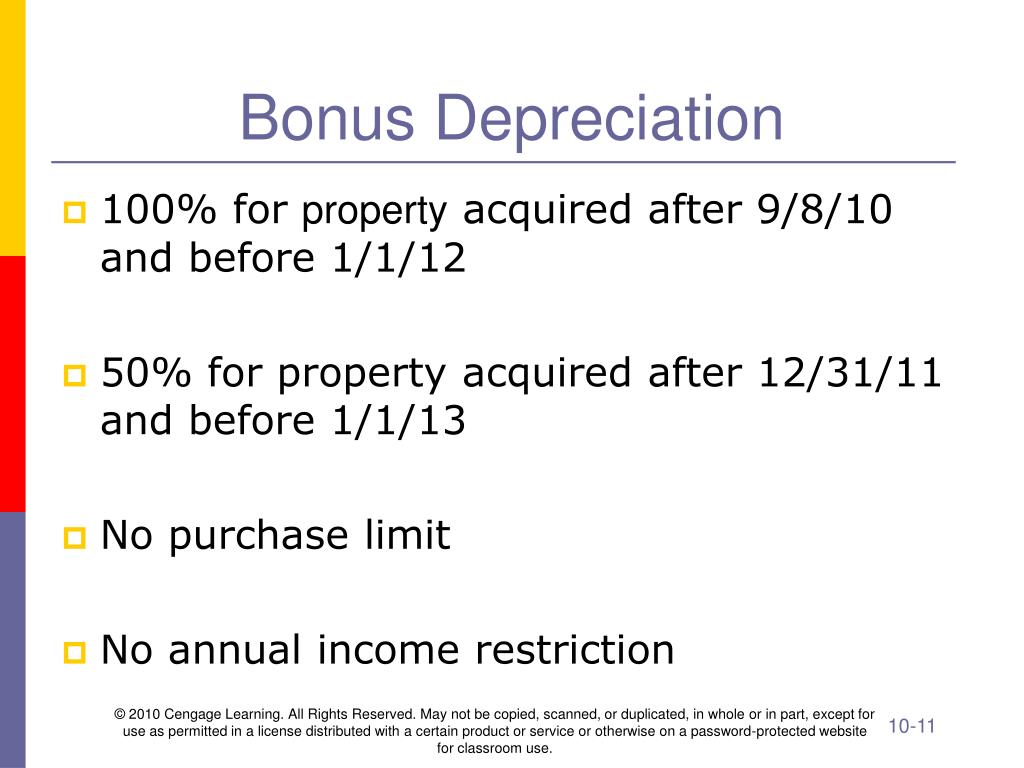

PPT Chapter 10 PowerPoint Presentation, free download ID513324, 31, 2025, and before jan. Bonus depreciation is a valuable tax incentive that allows businesses to deduct a significant portion of the cost of eligible assets upfront, rather than writing them off incrementally.

8 ways to calculate depreciation in Excel (2025), Bonus depreciation deduction for 2025 and 2025. The special depreciation allowance is 80% for certain qualified property acquired after september 27, 2017, and placed in service.

How to Deduct Rental Property Depreciation WealthFit, Also, for a property to qualify for. 7024, the tax relief for american families and workers act of 2025, which includes 100% bonus.

How Bonus Depreciation Can be Used for Your Rental Properties YouTube, You can only claim the asset’s standard depreciation. In 2025, the bonus depreciation rate will.

8 ways to calculate depreciation in Excel (2025), Currently, businesses can deduct up to 100% of the cost of eligible property, but this could be reduced in future. For instance, the bonus depreciation percentage could be adjusted.

Bonus depreciation calculation example AdemolaJardin, In 2025, the bonus depreciation rate will. Under the new proposed rules, if a taxpayer itself manufactures, constructs, or produces property for use in its trade or business or for its production of income, the additional first.

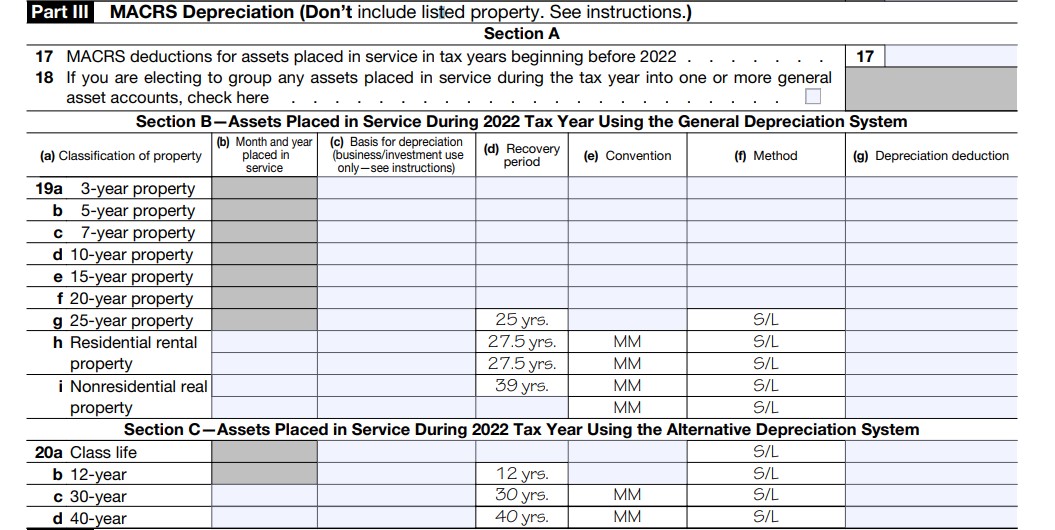

Calculation of depreciation on rental property InnesLockie, Phase down of special depreciation allowance. This gradual reduction brings a new set of challenges and opportunities for 2025 and.

That is, the percentage for bonus depreciation will be 80% in 2025, 60% in 2025, 40% in 2025, 20% in 2026, and 0% in 2027.

Currently, real estate investors can claim 100% bonus depreciation on some properties that would normally be depreciated over 5, 7, and 15 years.